Capital Gains Tax Changes: What's in Store for Canadians?

Taxing Capital Gains

Capital gains tax is levied on profits made from the sale of an asset, such as a stock, bond, or real estate. In Canada, only 50% of capital gains are currently taxable.

Proposed Changes

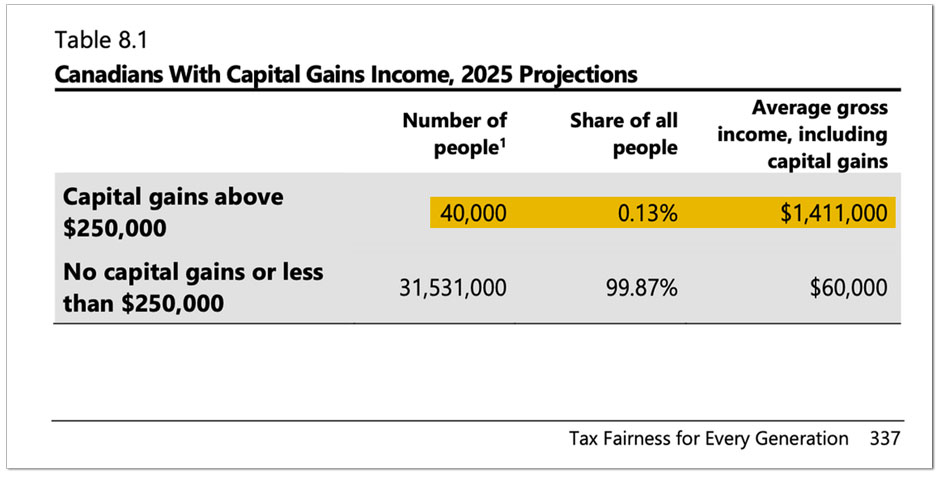

In Budget 2024, the federal government proposed increasing the capital gains inclusion rate to 66.67% for gains exceeding $250,000 for individuals. This means that individuals with gains above $250,000 will be taxed on two-thirds of their profits.

Impact on Investors

Positive Changes

- Individuals with capital gains under $250,000 will continue to be taxed at the current 50% rate.

- The lifetime capital gains exemption for business owners will increase to $125 million.

Concerns Raised

- Higher capital gains taxes may discourage investment and risk-taking.

- The changes may hinder business succession, as heirs may face higher tax burdens when inheriting assets.

Conclusion

The proposed capital gains tax changes aim to create a fairer tax system. However, they have sparked concerns among investors and business owners. It remains to be seen how these changes will impact the Canadian economy in the long run.

تعليقات